Future-focused organizations go beyond traditional benefits like health insurance and retirement plans. With an increased demand for lifestyle benefits, many employers offer Lifestyle Spending Accounts (LSA) and Flexible Spending Accounts (FSA) to enhance employee satisfaction and encourage healthy habits.

LSAs and FSAs are inclusive benefits offerings that provide additional funds to support employees’ health and wellness. Both give employees exceptional flexibility in how they spend benefit dollars, which boosts job satisfaction and loyalty. Understanding the differences between LSAs and FSAs and how these benefits work to support a total rewards strategy is a powerful way to attract and retain top talent.

In this article, we’ll explore the benefits of a Lifestyle Spending Account and a Flexible Spending Account to employees, the key differences between the two, and how offering each benefit can positively impact the effectiveness of the other.

Here’s what we’ll cover:

- Understanding LSAs and FSAs

- LSA vs. FSA: Key differences

- Elevate employee well-being with flexible benefits

Understanding LSAs and FSAs

Lifestyle Spending Accounts and Flexible Spending Accounts are both popular employee benefits that support health and wellness. Understanding the key characteristics of LSAs and FSAs can help employers tailor their benefits packages to meet the diverse needs of their employees.

Lifestyle Spending Account

A Lifestyle Spending Account empowers employees by offering personalized benefits that promote well-being and work-life balance, boosting engagement and productivity. LSAs show employees they matter by covering personal expenses not typically covered by a group health plan. When employers contribute to an LSA, employees spend their funds on what they care about, supporting their well-being.

Flexible Spending Account

A Flexible Spending Account is a tax-advantaged account that allows employees to manage out-of-pocket costs and set aside pre-tax money for eligible expenses. They’re sometimes categorized alongside Health Savings Accounts (HSAs), except that HSAs are only available to employees with high-deductible health plans.

LSA vs. FSA: Key differences

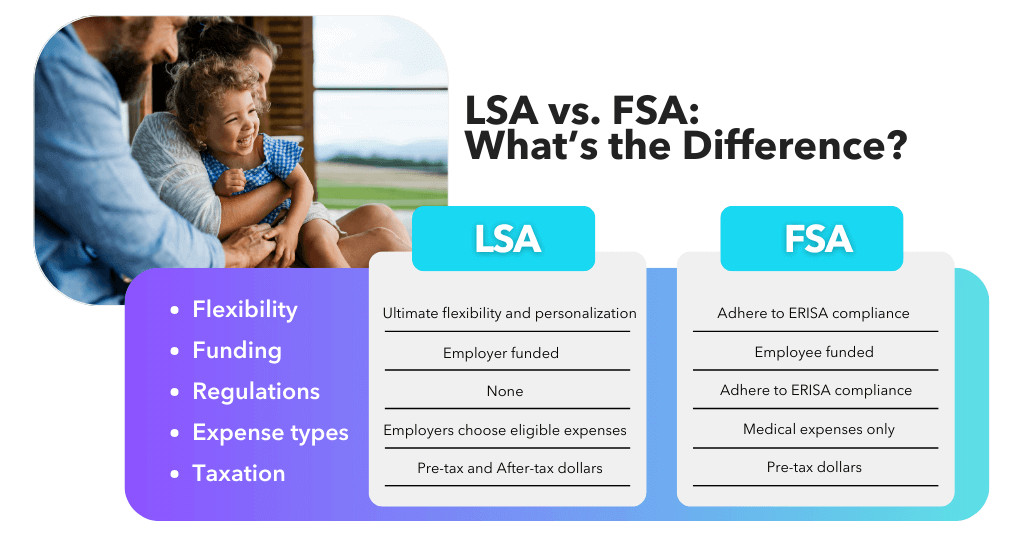

The key differences between a Lifestyle Spending Account and a Flexible Spending Account are how they’re funded, eligible expenses, and the applicable taxes and regulations. Ultimately, while both offer financial support for expenses related to health and wellness, LSAs provide greater flexibility and customization options than FSAs.

Flexibility and customization

A Lifestyle Spending Account offers a uniquely flexible and customizable approach to employee benefits. Flexibility of benefits empowers employees to support what they care about most in life.

A Flexible Spending Account follows standards and limits set by ERISA (Employee Retirement Income Security Act), which plays a significant role in shaping the structure of FSAs. Let’s say a company wants to offer a unique option that allows employees to contribute a portion of their FSA funds to a wellness program. While this offering could benefit employee health and well-being, ERISA’s guidelines may exclude target wellness expenses.

Eligible expenses

LSAs reimburse employees for a broad range of eligible expenses beyond healthcare. These include expenses related to fitness, mental health, work-from-home and work-from-office, family care, financial services, commuting, and tuition.

FSAs focus on medical expenses not covered by health insurance, as well as dependent care expenses. Typically covered expenses include deductibles and copayments, prescription medications, dental and vision care, childcare, and care for elderly family members and those with disabilities.

How they’re funded

LSAs are employer-funded accounts. Companies allocate a specific amount of money for each employee to use within the LSA and have full discretion over expense categories, restrictions, and guidelines. According to Espresa’s 2023 Benchmark and Trends Report, most employers offer reimbursements between $500 and $1,500 annually.

FSAs are employee-funded accounts. Employees who choose to participate in an FSA can contribute up to $3,200 through payroll deductions during the 2024 plan year, according to the IRS.

Taxes

LSAs use after-tax funds with exceptions for tuition, commuter, and work-from-home expenses. A taxable benefit allows employers more freedom to determine eligible expenses tailored to employee preferences.

FSA contributions are pre-tax dollars and are not subject to federal taxable income, Social Security tax, or Medicare tax. The tax benefits of FSAs and other spending accounts make them a valuable tool for managing healthcare costs and maximizing after-tax funds.

Rules and regulations

LSAs have fewer regulatory requirements and a reduced administrative burden from HR to finance. LSA funds are employee stipends without strict enrollment periods or annual contribution requirements, limiting their expense liability and financial risk to employers. LSAs give companies more freedom to engage their employees while serving an organization’s mission, vision, and values.

FSAs are more strictly regulated, subject to open enrollment, and have annual contribution limits. For FSAs that permit the carryover of unused funds, the maximum carryover amount from 2024 to 2025 is $640.

Elevate employee well-being with flexible benefits

Lifestyle Spending Accounts and Flexible Spending Accounts are dynamic duos that boost employee well-being and productivity. Together, they offer a comprehensive employee benefits package that caters to diverse needs, from mental and physical health to personal growth. By promoting preventive care and reducing healthcare costs, these inclusive benefits create a healthier, happier workforce.

How to Promote Health Equity in the Workplace: A Guide For Employers

Alex Shubat

Alex Shubat is the co-founder and CEO of Espresa, based in Palo Alto, California.

More by Alex Shubat