In today’s competitive job market, offering flexible employee benefits is crucial for attracting and retaining top talent. Lifestyle Spending Accounts (LSAs) stand out as the ultimate flexible employee benefit that employers can offer. LSAs offer employees freedom of choice while promoting a positive and inclusive workplace culture, even in uncertain times.

However, finding the necessary funds in the budget to support LSAs can be a significant concern for many organizations. Today’s HR professionals face the challenge of balancing budgetary constraints with employee expectations. According to a recent report by Gartner, 25% of HR budgets decreased in 2023 compared to 12% in 2022, and 28% of leaders reported stagnant budgets year over year.

In this article, we’ll explore some creative ways to fund an LSA program that delivers the flexible benefits your employees value most. It may be easier than you think to personalize your benefits offerings, optimize investments, and boost your employees’ engagement — all within your existing budget.

Here’s what we’ll cover:

- How to fund an LSA program for your employees

- What happens to unused LSA funds?

- Unlock the power of your investment

How to fund an LSA program for your employees

The most common way to fund an LSA for your employees is to utilize your existing resources. Many of today’s employers are finding ways to repurpose their existing budgets to increase efficiency and improve employee value in strategic benefit solutions. Funding an LSA does not always require extra investment! You can boost the perceived value of your employee benefits strategy, match your organization’s mission and vision, and adjust to evolving employee needs without an increase in budget.

1. Consolidate budgets

Assess your current spending and conduct a cost-benefit analysis. Identify the benefits most valued by your employees and prioritize their top needs. Customizable benefits like LSAs allow employees to choose what matters most to them. By taking a step back and employing a strategic approach to your budget, you can save on costs while catering to diverse employee needs.

Even better, consolidating multiple, disjointed benefits solutions into one streamlined solution allows for higher adoption and engagement.

2. Replace previous onsite perks

Strategically adjust onsite perks to improve employee benefits. Be sure to retain any highly valued perks that directly contribute to productivity and employee satisfaction. Minimize disruption and allow employees to adjust by implementing changes incrementally. And roll out new benefits simultaneously.

As organizations continue to balance in-office and remote schedules, reconsider their physical work spaces, and reinvigorate their company cultures, now is the time to adjust onsite benefits to meet the evolving needs of your people.

3. Reallocate real estate savings

Organizations that have downsized offices, renegotiated leases, or transitioned to remote or hybrid work arrangements should consider reallocating their real estate budgets toward supporting employee well-being. By aligning your strategies with changing work dynamics and employee priorities, you can create a more attractive and competitive work environment while effectively managing costs.

4. Repurpose incentive dollars

Assess your existing incentive programs and well-being dollars. Identify which programs are most effective and valued and keep them in place. Consider replacing some less effective monetary incentives with rewards and recognition awards to boost culture and morale. The goal is to find a balance between recognizing and rewarding performance while investing in the overall well-being and long-term financial security of your workforce.

Read: 21 Creative Employee Recognition Ideas for a Happy Workforce

5. Redistribute HSA contributions

Evaluate your company’s current Health Savings Account (HSA) contributions and analyze historical spending patterns and projections. Determine the portion of HSA contributions that is underutilized and can be reallocated. Enhanced lifestyle benefits can directly support broader well-being goals for your people, including family support, fitness classes, therapy, and mindfulness activities.

6. Adjust the actuarial value of your benefit offerings

Minor modifications to your LSA plan design can unlock immediate cost savings. Determine elements of your current employee benefits that drive value with your employees and those elements with lower perceived value. This might include deductibles, copayments, coinsurance rates, or out-of-pocket maximums.

Incentivize using high-quality providers or proactive management of specialty medical places of service, and produce savings without reducing the actuarial value of your strategic benefit offerings. Savings can be reinvested into an LSA reimbursement plan that generates added value and enhances employee engagement.

7. Exchange paid time off (PTO)

Evaluate your existing PTO policies, including the types of leave offered (vacation, sick leave, personal days), accrual rates, and any limitations. Determine the monetary value of unused PTO for each employee and offer customization options. Allow employees to choose how much they want to exchange their PTO for LSA funds.

It’s essential to keep employee total well-being as your top priority. Establish a clear process for tracking PTO exchanges, documenting employee choices, and monitoring benefit contributions.

What happens to unused LSA funds?

Since LSAs are employer-sponsored accounts, only the employer can contribute funds, and there are no annual contribution minimums or limits. Completely customizable, LSA program costs are set by individual employers. Nearly 70% of Espresa clients offer between $250 and $1,000 annually per employee in 2023.

A “use it or lose it” approach to LSA funding at the end of a plan year avoids various accounting complexities related to deferred compensation. LSAs are notional accounts. When employers only spend what employees use in a plan year, it means no dollars are wasted, and all benefits funds are utilized and appreciated.

Unlock the power of your investment

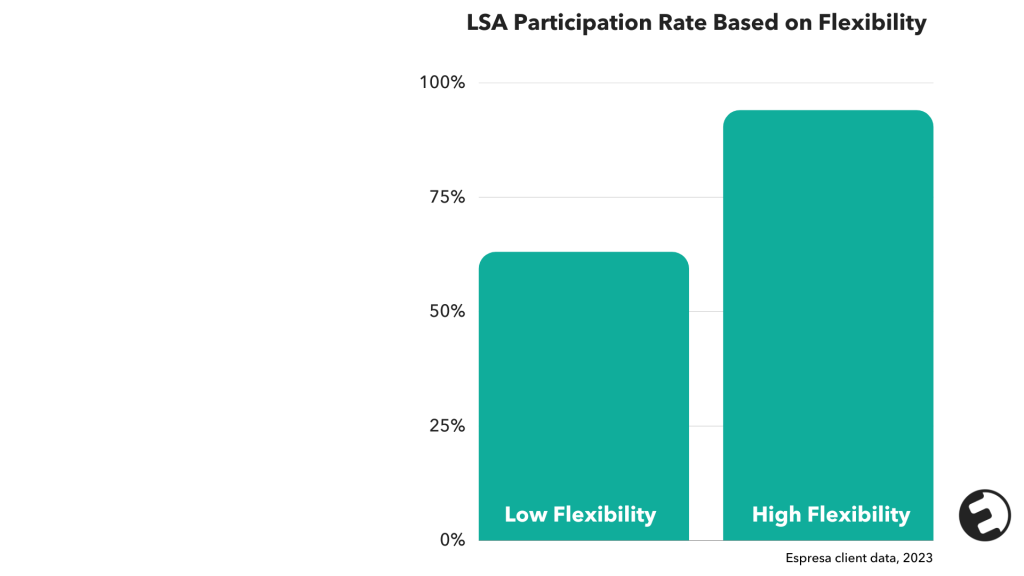

LSAs are customizable and personalized to each organization. A credible Return on Investment (ROI) is hard to evaluate broadly. The Value of Investment (VOI) is a more accurate and effective measure of success. Broad-based LSA programs have an 85% employee participation rate, and the greater the flexibility of your LSA program, the higher the employee participation.

Employee participation is central to an effective employee benefits strategy, and multi-dimensional well-being programs have the highest employee utilization.

Download: Espresa’s LSA 2023 Benchmark and Trends Report

Elevate benefits, not costs

Empower your workplace with flexible benefits that prioritize total well-being. With elevated employee benefits, everyone wins. And with a holistic approach to benefits spending, you can lighten the administrative burden and save your budget while exceeding employee expectations.

Level up your benefits game and make sure LSAs are part of your broader employee benefits strategy. Reach out to our team for a demo of Espresa’s LSA platform today.