In today’s dynamic economic landscape, the rising cost of living presents financial challenges for employees. Forward-thinking businesses and HR leaders can empower their workforces to meet these challenges head-on. By implementing robust financial wellness programs, organizations can equip employees to weather economic storms and thrive in their personal and professional lives. This guide will explore the impact of economic pressures on employee well-being and productivity, offering actionable strategies to foster financial resilience.

Here’s what we’ll cover:

- What is financial well-being?

- How can employers support employee financial well-being?

- How to implement an effective financial well-being program

- Incentivize financial well-being with LSA Plus

What is financial well-being?

Financial well-being is a state of feeling secure about one’s finances and financial future. PwC’s Employee Financial Wellness Survey found that 60% of full-time employees are stressed about their finances. Even among employees earning $100,000 or more per year, nearly half are stressed about their finances.

When employees can fully meet current and future financial obligations, they have the freedom to make choices that enrich their lives. In practical terms, financial well-being means having control over day-to-day finances, the ability to resist economic shocks, and having the power to achieve financial goals.

Offering financial wellness benefits, such as access to retirement planning tools and debt repayment resources, can empower employees to manage their finances effectively and reduce stress, leading to improved overall well-being and productivity.

Today’s high cost of living

The high cost of living is squeezing employee finances, making it harder to meet basic needs and save for the future. Rising prices for essentials like housing, food, and transportation reduce purchasing power, while increased debt burdens and difficulty saving further exacerbate financial instability. Inflation erodes wages, making it even more challenging for employees to maintain financial security.

The impact of financial instability on employees

Financial stress and instability are invisible burdens carried by employees. Constant worry about finances diverts focus and energy from work responsibilities and leads to anxiety, depression, higher rates of presenteeism and absenteeism, and decreased productivity—impacting both employees’ well-being and job performance. In some cases, financial instability can force employees to seek additional work or longer hours, intensifying stress levels and potentially leading to burnout.

Smart leaders recognize the impact of financial stress and create a supportive work environment. Employees who feel financially secure are more likely to stick around and engage more fully at work. Retirement benefits and financial wellness programs are key drivers of retention, showing employees that their company cares about their long-term well-being.

How can employers support employee financial well-being?

Forward-thinking organizations that invest in their workforce prioritize employee well-being and recognize the link between financial health and job performance. These business leaders are committed to creating a positive and supportive work environment where employees can thrive.

Espresa’s Benchmark and Trends Report highlights the rise in spending on financial well-being (~8%) and mental health (~3%), signaling growing employee awareness of overall well-being. By empowering employees with financial knowledge and tools, you can boost morale, increase productivity, and attract top talent.

Financial Education and Guidance

Knowledge equips employees to make informed decisions about their finances, reducing anxiety and promoting a sense of control. Educational resources and tools can help employees understand strategies for budgeting, debt reduction, and saving. Differentiate offerings – workshops, webinars, and online resources – to appeal to a variety of learning styles.

One-on-one financial coaching

Personalized one-on-one financial counseling empowers employees to tackle specific financial challenges discretely and create customized financial roadmaps. Tailored support alleviates financial stress and provides actionable strategies to improve financial well-being.

Debt Management Tools

Targeted financial well-being programs offer debt consolidation services and credit counseling, empowering employees to conquer debt and boost credit scores. This approach can significantly alleviate financial stress and supercharge overall well-being.

Emergency Savings Support

Implement emergency savings programs that help employees save for unexpected expenses. Forty-seven percent of employees surveyed by Betterment said an employer-sponsored emergency fund would “entice” them to change jobs. Tools for building emergency savings can provide a much-needed safety net for employees, reducing the fear of financial instability.

Retirement Planning Guidance

Future-focused well-being initiatives empower employees to ensure they’re on track to achieve retirement goals. Boost participation in retirement plans with automatic enrollment and matching contributions. Helping employees plan for retirement can alleviate long-term financial anxiety and promote peace of mind.

How to implement an effective financial well-being program

Employee financial wellness programs can offer a lifeline for employees struggling with economic challenges.

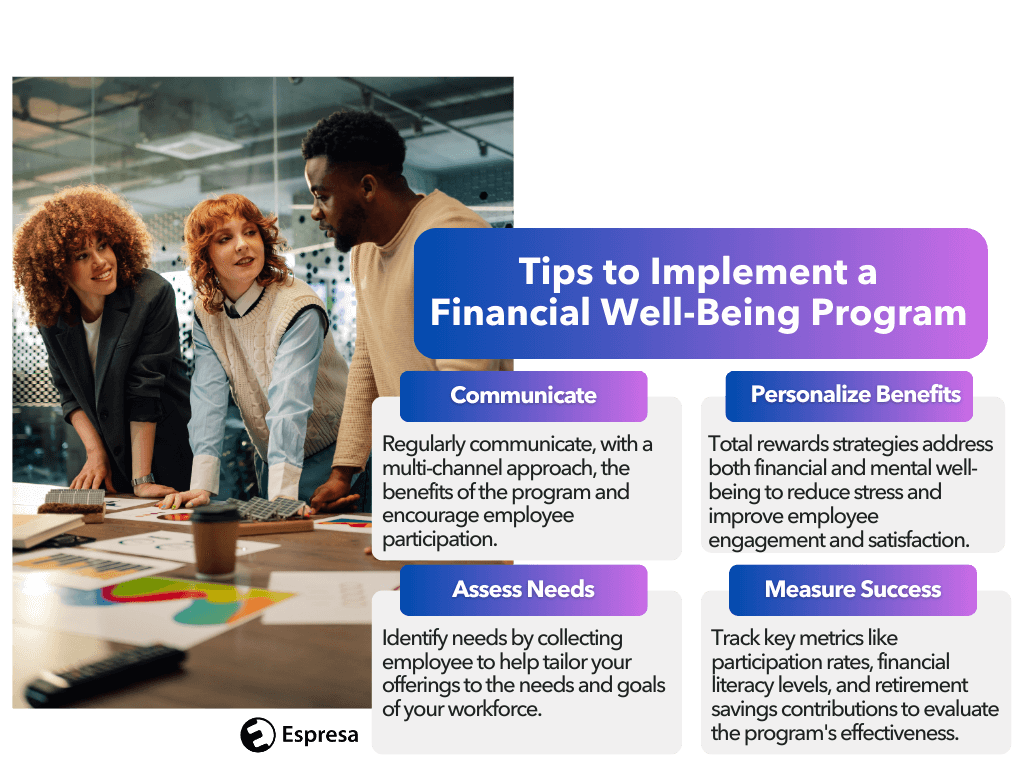

1. Assess employee needs

The key to meeting employee needs lies in understanding their unique experiences and aspirations. Empower employees by conducting surveys, focus groups, or one-to-one meetings to understand their specific financial concerns and goals. Utilize financial literacy screenings to gauge employees’ understanding of budgeting, saving, and investing strategies. The data collected will allow you to tailor your offerings to the needs and aspirations of your workforce.

2. Offer personalized benefits

A comprehensive total rewards strategy should address both financial and mental well-being. Financial stress often manifests as mental health challenges, so it’s crucial to offer emotional support for employees navigating stress and anxiety around finances. Lifestyle Spending Accounts (LSA) provide a uniquely flexible, personalized approach to benefits. Employees can spend their LSA funds on a wide range of eligible expenses based on their unique needs.

3. Communicate effectively

Routinely communicate the value of your financial well-being program and inspire employee participation. Utilize a multi-channel approach – internal communications, workshops, digital platforms, and personalized outreach – to ensure employees are aware of the program’s goals and motivated to engage. Offer incentives or rewards to recognize participation and celebrate financial well-being milestones.

4. Measure success

Tracking key metrics like participation rates, financial literacy levels, and retirement savings contributions measures your program’s success. PwC’s Employee Financial Wellness Survey revealed that organizations prioritizing financial wellness significantly enhance overall employee well-being. Flexible benefits programs empower employers to adapt offerings to meet evolving employee needs.

Incentivize financial well-being with LSA Plus™

A comprehensive platform empowers HR leaders to streamline initiatives on a single app, aligning employee financial well-being goals with your organization’s mission, vision, and values. Elevate your financial well-being program with incentives and earned allowances to encourage healthy behaviors and foster employee financial stability.

With Espresa, wellness incentives from challenges can be redeemed in our integrated marketplace or rolled into an incentivized Lifestyle Spending Account (LSA) wallet with our unique LSA Plus™. Contact us today to schedule a demo!

Streamlining Employee Reimbursement: The Benefits of Repaying Employee Expenses