Lifestyle Spending Accounts (LSAs) are the ultimate competitive benefits for organizations looking to empower employees and foster a thriving workplace through employer-funded accounts. Creating a realistic budget for an LSA program ensures its long-term success. Companies boost job satisfaction, improve work-life balance, and attract top talent by offering employees the flexibility to use LSA funds for a wide range of personal expenses.

A sustainable Lifestyle Spending Account budget considers your organization’s financial well-being and fosters a positive work environment. In this article, we’ll explore how to create a budget aligned with your long-term goals and commitment to supporting employee well-being.

Here’s what we’ll cover:

- Tips for creating a budget for Lifestyle Spending Accounts

- How to future-proof your LSA budget

- Budget for the ultimate competitive employee benefits

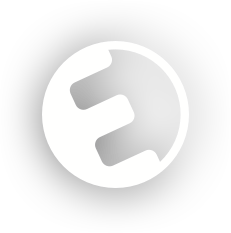

Tips for creating a budget for Lifestyle Spending Accounts

1. Determine the purpose and business goals of the LSA

Determine your LSA program’s purpose and business goals by aligning them with your mission, vision, and company values. Utilize an LSA to encourage holistic wellness activities by reimbursing meditation apps, nature retreats, fitness classes, or healthy cooking classes. Incentivize physical fitness and a culture of overall wellness by offering rewards for engaging in diverse wellness activities or participating in inclusive, company-sponsored wellness challenges.

LSAs can encourage employees to return to the office by offering benefits like a work-from-office allowance and commuter benefits that make in-person work more appealing and support in-office activities.

By aligning organizational goals with employee preferences, companies can design an LSA program that maximizes value and benefits for both employees and the organization.

2. Tap into employee needs and interests

Employers can tap into employee desires by conducting surveys or focus groups to discover what employees crave. This insider knowledge of your diverse workforce will help pinpoint interest in expense categories, from gym memberships to financial planning and mental health resources to wellness expenses. According to Mercer’s 2024 Health and Benefits Strategy Survey, lifestyle accounts are increasingly popular in support of life-enhancing pursuits in the workforce.

By gathering valuable feedback, employers can craft a budget that aligns with employee needs, maximizing program effectiveness and boosting employee satisfaction. Empower your employees and make the most of your LSA budget by offering benefits that truly resonate and align with employees’ needs and interests while ensuring that eligible expenses are carefully tailored.

3. Analyze current employee benefits spending

Employers can identify hidden funding opportunities for an LSA by strategically analyzing current employee benefit spending. Examine underutilized budgets, consolidate point solutions and integrate existing well-being vendors, to reduce administrative burden, realign perks and stipends, repurpose incentives, and adjust actuarial values or contribution strategies.

Additionally, comparing LSAs with other benefits options can provide further insights into optimizing your benefits strategy. Unlike more restrictive benefit offerings, like Flexible Spending Accounts, LSAs offer greater personalization options and a broader range of use, allowing for effective resource allocation based on workforce needs.

By taking a strategic approach to lifestyle benefits, employers can find funding within their existing budget and launch an LSA program to enhance their overall benefits package.

4. Estimate LSA participation rate

Employers can estimate LSA participation rates by tapping into historical data, past reimbursement claims, and industry insights. Analyzing previous benefit programs and researching industry benchmarks can provide a solid starting point. Employee surveys and effective communication can help gauge interest and encourage participation. By combining these methods, employers can create a more accurate estimate of LSA participation rates and allocate their budget accordingly, ensuring a successful and impactful program.

Not all employees will fully use the LSA program, so there may be cost savings from unused LSA funds compared to initial estimates. It’s not just about the dollar value of employee benefits but also the perceived value of a benefit that matters to employees.

By carefully estimating the participation rate, employers can better plan their budget and ensure they only fund what employees utilize during the year.

5. Set an annual per-employee budget

When setting your LSA per-employee budget, consider factors like your company’s financial goals and employees’ unique interests. Benefit offerings typically range from $250 to $1000 per employee and are easily adjustable and expandable in the future.

By thoughtfully designing your eligible spending options and budget, you’ll create a program that empowers employees and boosts overall satisfaction.

6. Calculate your total budget

To calculate your maximum LSA budget, multiply the annual per-employee amount by the estimated number of participants. Align program design with targeted usage by considering a wide range of use cases, such as targeted employee interests, tailored communication strategies, flexible spending options, and choices to carry-forward unused funds (or not) within a plan year. Launch timing can also be a powerful way to stretch a year one program budget – starting on April 1 or July 1 with a prorated balance helps maximize funds, gauge employee participation, and provide a valuable benefit without overspending. These considerations ensure a broader strategic benefit offering that allows more choice and adaptability.

You can also consider an incentivized LSA program design where some funds are provided to all employees while others are earned for completing activities important to the organization’s mission. Any unused funds from the plan year can be reallocated or used to enhance the program in the future.

Keep in mind that while LSAs are taxable benefits, certain spending categories like tuition, commuter, and work-from-home expenses may be tax-advantaged.

How to future-proof your LSA budget

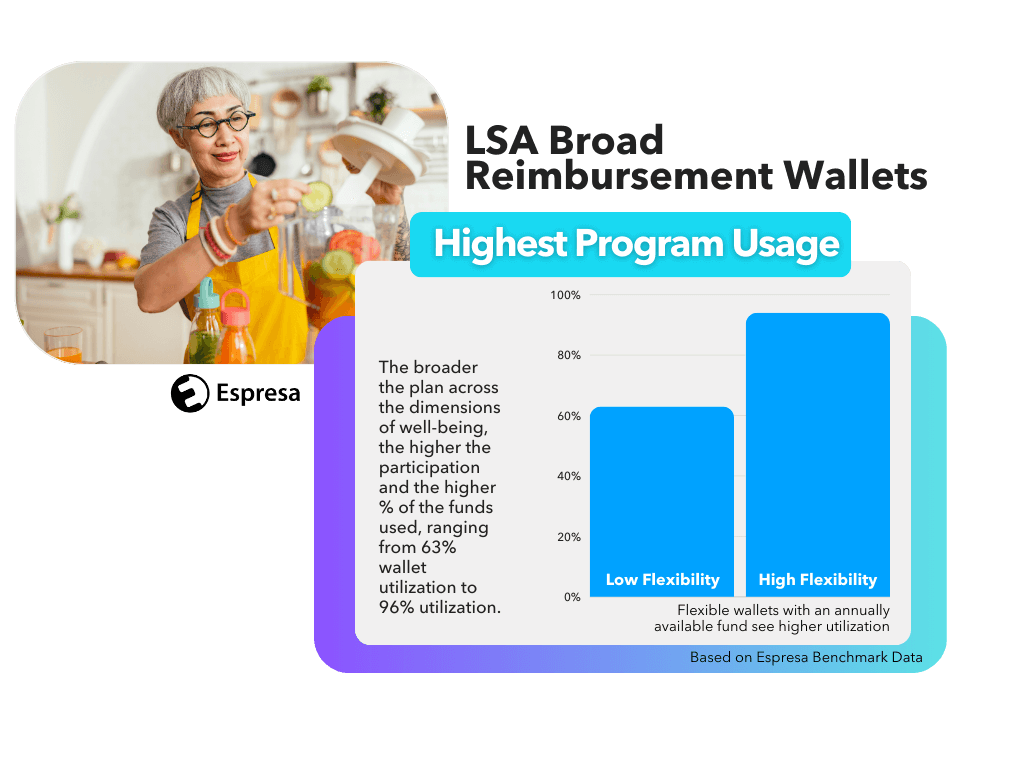

You can ensure the long-term success of your LSA by buffering your budget to accommodate increased participation, shifting costs, and team expansion. Plans are fully flexible and can be adjusted in real-time based on usage and feedback, ensuring they always align with company goals and meet employee needs without being constrained by fixed restrictions or regulations.

Proactive planning will help you create a resilient LSA that thrives, delivering ongoing value to your people from employer-sponsored accounts and driving future success.

Budget for the ultimate competitive employee benefits

A Lifestyle Spending Account is a win-win for employers and employees. By offering this flexible and customizable benefit, companies firmly commit to employee well-being and foster a more inclusive workplace. With a well-planned budget that aligns with company goals and employee needs, adding an LSA to your benefits program can provide a high return on value in increased employee satisfaction, productivity, and overall well-being.

Take advantage of the opportunity to elevate your benefits strategy and gain a competitive edge. Espresa’s LSA platform helps companies design Lifestyle Spending Account programs that boost engagement and set up HR teams for success. Schedule a demo and start exploring the possibilities of an LSA today!

7 Tips for a Winning Total Rewards Strategy to Attract Top Talent

Ryan Ramsey

Ryan is Espresa's Head of Strategic Alliances, based out of Colorado.

More by Ryan Ramsey